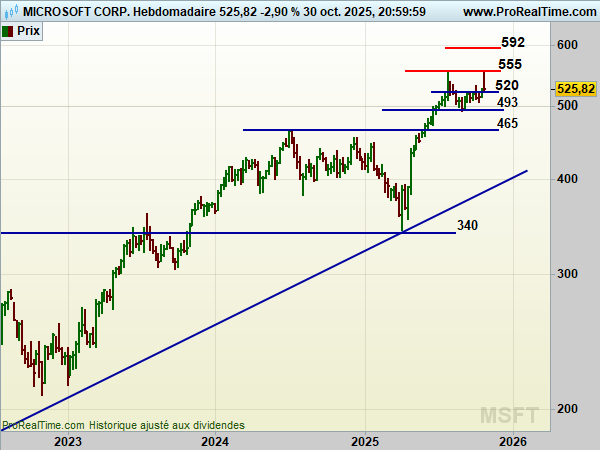

Microsoft shares are consolidating after an exceptional run, caught between a major technical resistance and fundamentals that remain among the strongest in the technology sector.

Since reaching an all-time high of $555 during the release of third-quarter results, the stock has shown signs of fatigue, sketching out a double-top formation that reinforces the importance of this barrier. Much like the previous consolidation phase, which saw an 11% decline to $492 before a sharp rebound, the market is once again hesitating to break through this ceiling. The current retreat has brought the stock back to around $525, within a zone between $520 and $530 that could represent an attractive entry point for medium-term investors. Conversely, a decisive break below $493 would open the way for a deeper correction toward $465, a historically defended level that would likely be seen as highly attractive.

From a fundamental perspective, Microsoft continues to deliver impressive momentum. The company began fiscal 2026 with quarterly revenue of $77.7 billion, up 18% year-on-year, and earnings per share of $4.13, a 23% increase. Cloud remains the main growth engine, with revenue of $49 billion (+26%), driven by Azure’s 40% growth rate. The massive integration of artificial intelligence across the portfolio—from Microsoft 365 Copilot to GitHub Copilot, as well as security and healthcare solutions—is fueling record adoption, with more than 150 million monthly active users of Copilot features and penetration across over 90% of the Fortune 500. The reinforced partnership with OpenAI, which includes an additional $250 billion in Azure commitments, further strengthens long-term visibility.

Financial projections remain robust. Analysts expect revenue to reach $430 billion by 2028, with a net margin above 36% and free cash flow exceeding $128 billion. The valuation, while still elevated at a 2026 P/E of 34.7x, is expected to gradually ease toward 25x by 2028, while the dividend yield, modest at 0.7%, is set to grow steadily. The average analyst price target stands at $621, implying nearly 15% upside from current levels, with an overwhelming majority of buy recommendations.

In summary, Microsoft is experiencing a technical pause after a powerful rally, but its fundamentals remain exceptional. The current zone around $525 can be viewed as a tactical entry point, provided investors accept the inherent volatility of a stock that has become emblematic of AI and cloud growth. A decisive breakout above $555 would signal the start of a new bullish cycle toward $569, $578, and $592, while a return toward $465 would present a rare, but unlikely, opportunity for patient investors.